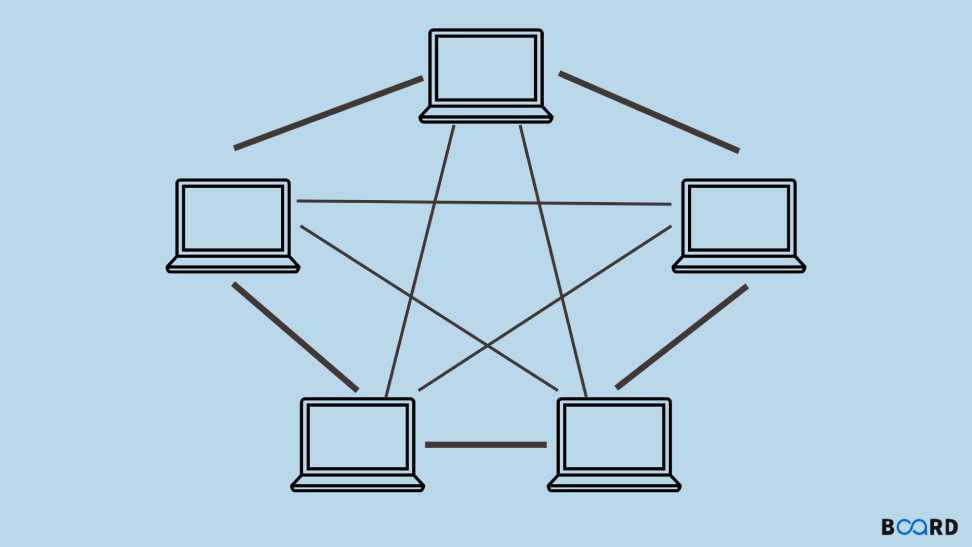

Lotus299, Goldenexch, Msdexch: Blockchain technology is a decentralized and distributed system that securely records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous blocks, forming a chain. This chain cannot be altered or deleted, ensuring transparency and immutability of the stored information.

The key components of blockchain include cryptographic hash functions, consensus algorithms, and smart contracts. These elements work together to verify and validate transactions without the need for a middleman, such as a bank or financial institution. This innovative technology is revolutionizing various industries by enhancing security, efficiency, and trust in digital transactions.

Benefits of Implementing Blockchain in Insurance

Blockchain technology has revolutionized the insurance industry by enhancing transparency and security in handling transactions. Through the implementation of blockchain, insurers and policyholders can access an immutable record of all insurance transactions in a decentralized network. This feature reduces the risk of fraud and improves the efficiency of claim processing by eliminating the need for intermediaries.

Furthermore, the use of smart contracts in blockchain technology automates and streamlines the claims process in insurance. These self-executing contracts are triggered automatically once predefined conditions are met, reducing the likelihood of delays or disputes in claims settlement. By leveraging blockchain in insurance, companies can enhance customer trust and satisfaction by providing a more efficient and reliable claims experience.

Challenges of Traditional Claims Processing

Aldoexch, Aaonline777, Aaonline247: Traditional claims processing in the insurance industry is riddled with inefficiencies that can lead to delays and errors. The manual handling of paperwork and the need for multiple checks and verifications contribute to a slow and cumbersome process. This often results in frustrated customers waiting longer than necessary for their claims to be processed, leading to a negative customer experience.

Moreover, the lack of transparency in traditional claims processing can lead to disputes between insurance providers and policyholders. Without a clear and easily accessible record of the claims journey, misunderstandings and disagreements can arise, further prolonging the resolution process. This not only creates added stress for all parties involved but also adds unnecessary costs to the insurance company.

What is blockchain technology?

Blockchain technology is a decentralized, distributed ledger system that records transactions across multiple computers in a way that is secure, transparent, and tamper-proof.

How can blockchain benefit the insurance industry?

Implementing blockchain in insurance can streamline claims processing, reduce fraud, improve data security, enhance transparency, and increase efficiency.

What are some challenges of traditional claims processing in the insurance industry?

Some challenges of traditional claims processing include lengthy processing times, manual paperwork, potential for errors, lack of transparency, and susceptibility to fraud.

Also Read:-

- How Does Upside Make Money?

- Kyle Baugher Networth, Lifestyle, Height, Career

- The Top 12 PC Games: From Epic Adventures To The Classic Solitaire

Feature image souce:- https://tinyurl.com/38dxzuf2